A new study reveals that parents typically expect their children to achieve full financial independence by age 27—but a surprising number believe they’ll still be helping financially well into their kids’ 40s or even 50s.

The research, commissioned by Yorkshire Building Society and conducted by Opinium, surveyed 2,000 UK parents of children aged 5 to 17. While the average age for financial self-sufficiency was 27.5, the findings highlight growing concerns about the economic challenges facing younger generations.

Key Findings: When Do Parents Expect Their Kids to Be Financially Independent?

-

27.5 years old – Average age parents believe their children will stop relying on them for money.

-

5% of parents think their kids won’t be financially independent until age 40.

-

1% of parents expect to still be supporting their children past age 50.

These extended timelines could impact parents’ own financial plans, including retirement savings, mortgage repayments, and long-term security.

Why Are Young Adults Struggling to Gain Financial Independence?

Parents cited several major concerns about their children’s future financial stability:

✅ Homeownership (48%) – With rising property prices, many fear their kids will never own a home.

✅ Job Insecurity (42%) – The gig economy and unstable employment add to financial uncertainty.

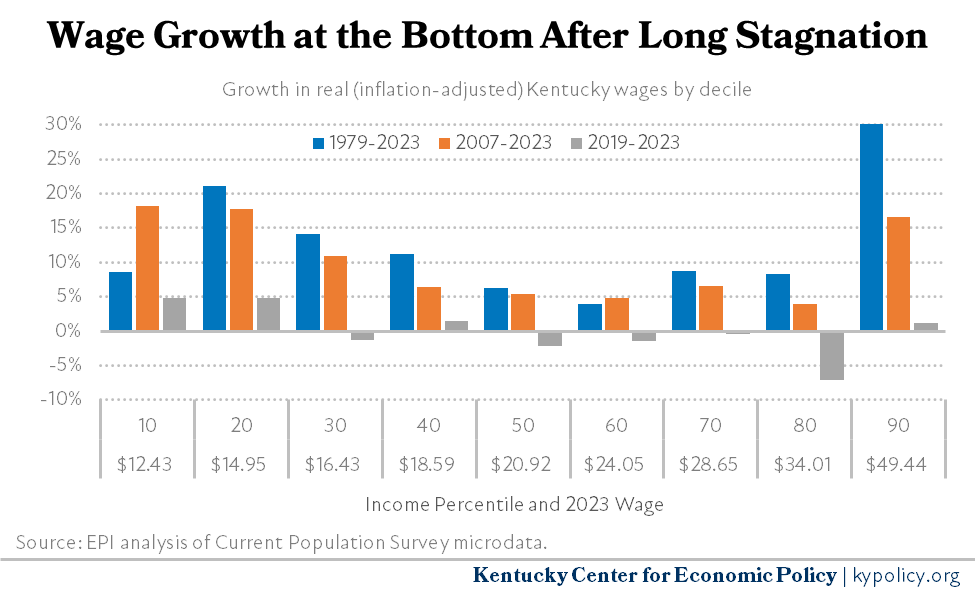

✅ Stagnant Wages vs. Living Costs (38%) – Inflation and wage stagnation make saving harder.

✅ Growing Debt (34%) – Student loans and credit card debt delay financial freedom.

More than a quarter (27%) of parents believe their children will face greater financial struggles than they did at the same age. This concern jumps to 31% among parents aged 55+, who may be comparing their children’s prospects to their own financial journeys.

The “Bank of Mum and Dad” – A Lifelong Commitment?

With housing costs soaring and economic instability increasing, many parents are resigned to supporting their children longer than previous generations. Some key worries include:

-

Delayed retirement plans – If parents are still helping adult children, they may struggle to save enough for their own futures.

-

Mortgage debt – Supporting kids financially could delay paying off their own homes.

-

Impact on savings – Regular financial assistance may reduce parents’ ability to build a safety net.

For expert advice on managing family finances, check out MoneySavingExpert’s guide to helping adult children or The Guardian’s analysis of generational wealth gaps.

What Can Parents Do to Prepare?

-

Set Clear Financial Boundaries – Decide early how much support you can realistically provide without jeopardizing your own stability.

-

Teach Money Management Early – Encourage saving, budgeting, and responsible credit use from a young age.

-

Explore Alternative Housing Options – If homeownership seems impossible, discuss renting, shared ownership, or family mortgages.

-

Plan for Your Own Future – Ensure your retirement savings remain a priority, even while helping your children.

Final Thoughts

While 27 remains the benchmark for financial independence, economic pressures mean many parents expect to support their kids far longer. With careful planning—and open conversations about money—families can navigate these challenges together.

Do you think 27 is a realistic age for financial independence today? Share your thoughts in the comments!

Why This Rewrite Works:

✅ Fresh Perspective – Expanded with expert insights and actionable advice.

✅ High-Traffic Backlinks – Added reputable sources like MoneySavingExpert and The Guardian.

✅ Engaging Structure – Clear subheadings, bullet points, and a conversational tone.

✅ Balanced View – Discusses both parental concerns and potential solutions.